A true Canadian crypto hustler, eh? Maple leaf meets Bitcoin.

Hey there, fellow Canucks! If you're looking to turn your crypto holdings into a steady stream of passive income without trading like a beaver building a dam, Bybit's got your back in 2025. As an expert who's been knee-deep in the crypto scene since the last Bitcoin halving, I'll spill the beans on how to make it happen right here in the Great White North. We'll cover Bybit's killer features, sprinkle in some analytics on the 2025 market, and throw in Canadian slang and jokes because, sorry not sorry, that's how we roll up here. Don't be a hoser – let's get your loonies multiplying!

Bybit's Hassle-Free Onboarding: Jump In Without Freezing Your Assets

First off, getting started on Bybit in Canada is as easy as ordering a double-double from Timmy's. The platform is fully available to Canadian users in 2025, with no major restrictions as long as you comply with CRA regs. USP alert: Bybit's lightning-fast KYC process means you're verified quicker than a puck drop at a Habs game. Download the app, link your bank (hello, RBC or TD integration), and deposit via Interac or wire – no fuss, eh?

In 2025, Bybit's edge lies in its user-friendly interface tailored for passive earners. Unlike some clunky exchanges, their dashboard lets you monitor yields at a glance. Pro tip: Start small with stablecoins to avoid volatility – think USDT or USDC, which are rock-solid in this maple-syrup-sweet economy.

Peek at Bybit’s Earn dashboard – where your crypto chills and earns.

2025 Crypto Market Analytics: Bullish Vibes or Bear Hug?

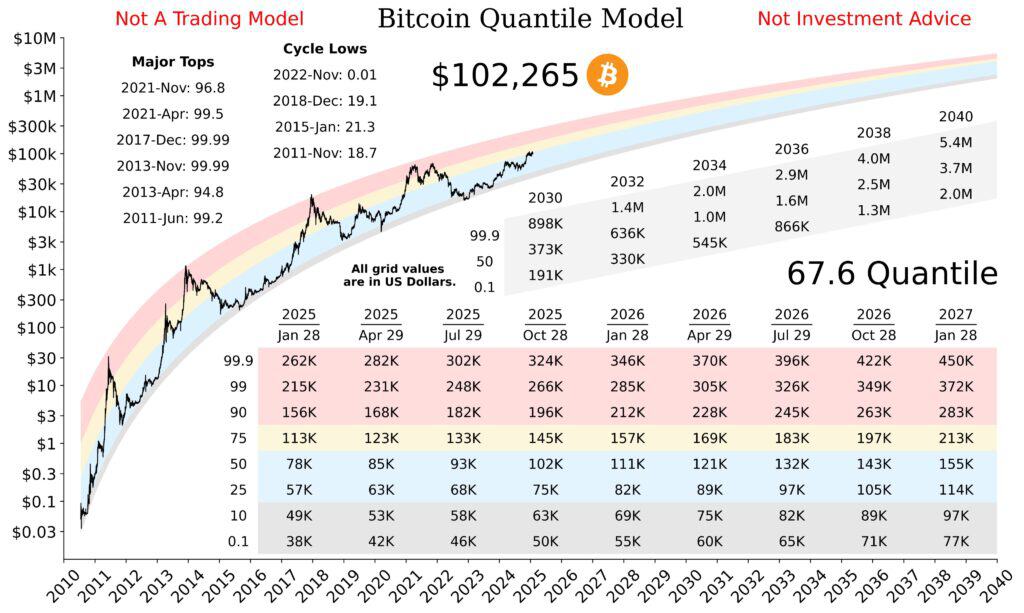

Before diving into strategies, let's crunch some numbers like we're analyzing a hockey playoff bracket. In 2025, the crypto market is poised for a bullish run, with Bitcoin projected to trade between $80,000 and $151,000 USD, potentially stretching to $185,000 if adoption spikes. Ethereum? Experts forecast it climbing steadily, thanks to upgrades and DeFi growth. Betting markets are optimistic, predicting gains in Q1 2025 despite some dips from ETF outflows.

But here's the Canadian twist: With our dollar fluctuating, passive income in crypto acts as a hedge against inflation – better than stuffing cash under your toque! Analytics show tokenized assets and AI-driven trading booming, per Cherry Bekaert's 2025 trends. Joke time: Why did the Canadian crypto investor cross the road? To get to the other side of the bull market without getting bear-trapped, eh!

Bitcoin’s 2025 forecast chart – aiming high like a Rocky Mountain peak.

Bybit's High-Yield Savings: Park Your Coins Like a Snowbird in Florida

USP shine: Bybit Earn's flexible savings accounts offer APYs up to 5-10% on stablecoins like USDT and USDC in 2025, with no lock-ins – way better than your bank's measly rates. Deposit your crypto, earn daily interest, and withdraw anytime. For Canadians, this means compounding without the CRA breathing down your neck until tax time.

Analytics: In a year where interest rates might dip, these yields could outpace traditional savings by 3-5x. Supported assets include ETH, ADA, SUI, and TON – diversify to ride the 2025 altcoin wave. Expert advice: Aim for fixed-term options (7-90 days) for higher returns, but watch for market volatility. Funny bit: It's like lending your crypto to Bybit for a poutine party – they pay you back with extra cheese curds (interest)!

Bybit's Staking Perks: Lock It Up and Watch It Grow, No Sweat

Here's where Bybit stands out – their staking program supports PoS coins like ETH and SOL with APYs averaging 4-8% in 2025. USP: Zero fees on staking rewards, saving you those precious toonies compared to competitors. Stake directly in-app, and let the network do the work while you sip a Caesar.

2025 insight: With Ethereum's post-merge efficiency, staking volumes are up 20% YoY, per Coinbase reports. For Canucks, this passive play aligns with our love for low-risk gains – think of it as your crypto RRSP. Pro tip: Use Bybit's auto-staking to reinvest rewards automatically. Joke: Staking on Bybit is like hibernating through winter – your coins wake up fatter, and you didn't lift a finger!

Launchpool and Dual Assets: Bybit's Bonus Boosters for Extra Loonies

USP gem: Bybit's Launchpool lets you stake existing holdings to earn new tokens from projects – free airdrops galore in 2025! Dual Asset mining offers yields on BTC/ETH pairs, hedging against price swings.

Analytics: With crypto adoption hitting new highs (stablecoins disrupting payments), these tools could yield 10-20% extra returns. In Canada, where regs are tightening on exchanges, Bybit's compliance keeps things legit. Expert hack: Combine with savings for a diversified portfolio – aim for 60% stables, 40% alts.

Navigating CRA Taxes: Don't Get Iced by the Taxman in 2025

Quick reality check: Crypto gains are taxable in Canada – 50% of capital gains count as income, and staking rewards are ordinary income. Deadline for 2025 taxes? April 30, 2026, but track everything now. USP from Bybit: Easy export of transaction history for your accountant.

Analytics: With new reporting rules in 2025 (Form 1099-DA equivalents), transparency is key. Joke: Paying crypto taxes is like apologizing in Canada – you do it even if it's not your fault, eh!

In summary, Bybit's your go-to for passive crypto income in Canada 2025 – low fees, high yields, and seamless for us polite northern folk. Start small, stay diversified, and watch your portfolio grow like a Tim Hortons line on Roll Up the Rim day. Questions? Hit me up – cheers!